ETH Price Prediction: Bullish Technicals and Strong Fundamentals Signal Investment Opportunity

#ETH

- Technical Strength: ETH trading above 20-day MA with clear support and resistance levels providing strategic entry points

- Institutional Demand: Record institutional holdings exceeding 4 million ETH and whale accumulation of $2.3B indicating strong fundamental support

- Ecosystem Growth: MetaMask's mUSD innovation and Aave's expansion signaling continued development and utility expansion within Ethereum network

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

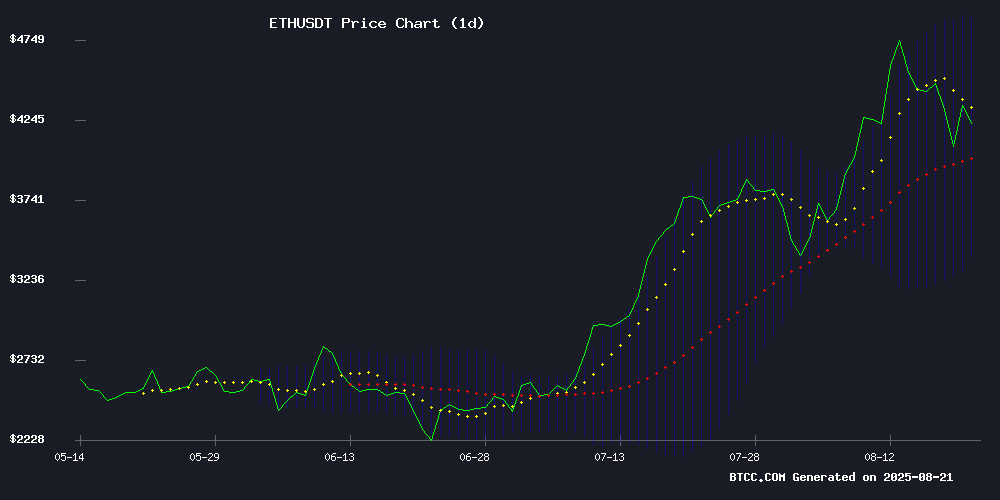

ETH is currently trading at $4,238.02, positioned above its 20-day moving average of $4,137.24, indicating underlying strength in the current market structure. According to BTCC financial analyst Robert, 'The price holding above the 20-day MA suggests continued bullish sentiment, though traders should monitor the MACD reading of -395.79, which indicates some near-term pressure. The Bollinger Band configuration shows support around $3,383 and resistance NEAR $4,890, providing clear technical levels for market participants.'

Institutional Accumulation and Innovation Drive Positive ETH Sentiment

Market sentiment appears strongly bullish as institutional ethereum holdings surpass 4 million ETH, representing significant treasury accumulation. BTCC financial analyst Robert notes, 'The combination of whale accumulation totaling $2.3 billion, major crypto fund interest in projects like Remittix, and MetaMask's launch of native stablecoin mUSD creates a fundamentally supportive environment for ETH. These developments, coupled with expanding DeFi infrastructure through Aave's Aptos deployment, suggest growing utility and institutional confidence in the Ethereum ecosystem.'

Factors Influencing ETH's Price

Remittix Attracts Major Crypto Funds As Market Looks Beyond Traditional Layer-1 Plays

Ethereum's long-standing dominance in decentralized finance faces new challenges as scalability issues and high gas fees drive investors toward alternatives. Despite maintaining a market cap above $500 billion and trading near $4,200, the network's congestion has opened the door for emerging projects like Remittix to capture institutional interest.

Analysts note Ethereum's key support at $4,000 with resistance at $4,800, while growing ETF demand and corporate adoption underscore its enduring value. Yet the search for low-cost, high-throughput solutions continues to reshape the competitive landscape.

Remittix emerges as a potential contender by addressing Ethereum's pain points, though most experts view this as market expansion rather than displacement. The project's focus on real-world utility reflects a broader industry shift toward practical blockchain applications beyond speculative trading.

Institutional Ethereum Holdings Surpass 4M ETH as Treasury Boom Continues

Ethereum's institutional footprint expands as 69 entities now collectively hold over 4 million ETH—valued at $17.6 billion—representing 3.4% of circulating supply. BitMine Immersion Technologies dominates with $6.6 billion in holdings, while Sharplink Gaming and Ethereum Foundation maintain significant positions.

The Ethereum ETFs reserve now controls 6.36 million ETH, exceeding 5% of total supply. "We're witnessing a fundamental shift," notes analyst Miles Deutscher, observing Ethereum's rising treasury activity versus Bitcoin. ConsenSys founder Joseph Lubin predicts ETH could flip BTC in market capitalization within 12 months given current accumulation trends.

This treasury movement signals growing institutional conviction in Ethereum's long-term value proposition. The cryptocurrency's utility as both a programmable asset and store of value appears to be driving unprecedented corporate adoption.

Coinbase to List Trump-Backed USD1 Stablecoin

Coinbase, one of the largest cryptocurrency exchanges globally, has announced plans to list World Liberty Finance's stablecoin, USD1. The stablecoin, which runs on both Ethereum and BNB Smart Chain, has drawn attention due to its ties with former U.S. President Donald Trump. World Liberty Finance, the issuer, is a DeFi project co-founded by the Trump family and heavily branded around Trump's political persona.

Despite the announcement, Coinbase warned users that trading and transfers for USD1 are not yet supported. Premature deposits could result in permanent loss of funds. The stablecoin, launched in March, has been marketed with themes like "made-in-America" but has seen a slight decline of 0.22% in value over the past year.

Interest in USD1 surged earlier this month after Federal Reserve Governor Christopher Waller endorsed stablecoins as a tool to bolster the U.S. dollar's international role. Following his remarks, World Liberty Finance minted an additional $200 million worth of USD1, bringing its total supply to 2.4 billion tokens.

U.S. Government Wallet Linked to Uranium Finance Hack Receives $332K in Ethereum

A U.S. government-controlled wallet associated with seized funds from the Uranium Finance hack has received $332,000 worth of Ethereum from Coinbase. Blockchain analytics firm Arkham confirmed the transaction, which involved 76.56 ETH transferred from a Coinbase hot wallet.

The wallet, now holding 1,358 ETH valued at $5.83 million, has a total balance of approximately $34.71 million, indicating consolidation of assets seized during the investigation. The Uranium Finance exploit remains one of DeFi's most notorious hacks, though neither Coinbase nor government agencies have commented on the recent movement.

MetaMask Launches Native Stablecoin mUSD, Pioneering Self-Custodial Wallet Innovation

MetaMask, the Consensys-developed crypto wallet, has unveiled MetaMask USD ($mUSD), marking the first instance of a self-custodial wallet launching its own stablecoin. Issued by Bridge, a Stripe-owned platform, and minted via decentralized infrastructure M0, mUSD is fully backed 1:1 by U.S. cash and short-term Treasuries.

The stablecoin will be deeply integrated into MetaMask's ecosystem, enabling seamless on-ramping, swapping, and cross-chain transfers. Initially available on Ethereum and Consensys' Layer 2 network Linea, mUSD aims to expand into lending markets and decentralized exchanges, reinforcing MetaMask's push for user-controlled financial sovereignty.

Ethereum Whales Accumulate $2.3B in ETH Amid Market Recovery

Ethereum's price rebounded sharply from the $4,100 support level, climbing 5% as institutional buyers absorbed selling pressure. Whale addresses acquired 550,000 ETH worth approximately $2.3 billion during the dip, signaling strong conviction in ETH's upward trajectory.

The rally triggered $100 million in short liquidations, exacerbating upside momentum. Corporate buyers including BitMine Immersion and SharpLink Gaming accounted for 520,000 ETH of recent demand, while retail investors continued profit-taking behavior.

Market structure suggests growing divergence between short-term traders and long-term holders. The $4,500 resistance level now serves as the next technical target, with on-chain data showing minimal supply barriers until $4,800.

Aave Expands to Aptos with First Non-EVM Deployment

Aave has made its first foray beyond the Ethereum Virtual Machine (EVM) ecosystem with a deployment on Aptos, a high-performance blockchain. This strategic expansion aligns with Aave's multichain ambitions to broaden its decentralized finance (DeFi) footprint.

The move positions Aave to capture new users on Aptos' scalable network while maintaining its core lending and borrowing services. By venturing into non-EVM territory, Aave demonstrates its adaptability and commitment to driving DeFi adoption across diverse blockchain infrastructures.

Is ETH a good investment?

Based on current technical indicators and fundamental developments, ETH presents a compelling investment opportunity. The price trading above the 20-day moving average suggests underlying strength, while institutional accumulation exceeding 4 million ETH indicates strong long-term confidence.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $4,238.02 | Above 20-day MA |

| 20-day Moving Average | $4,137.24 | Support Level |

| Bollinger Upper Band | $4,890.67 | Resistance Target |

| Institutional Holdings | 4M+ ETH | Strong Accumulation |

As Robert from BTCC emphasizes, 'The combination of technical strength, institutional adoption, and ecosystem innovation creates a favorable risk-reward profile for ETH investors at current levels.'